Daily Chart

Looking at the daily chart, I still think that the rally is a wave B rally in an expanded flat, which means we can start looking for nice shorting opportunities once the rally is complete.

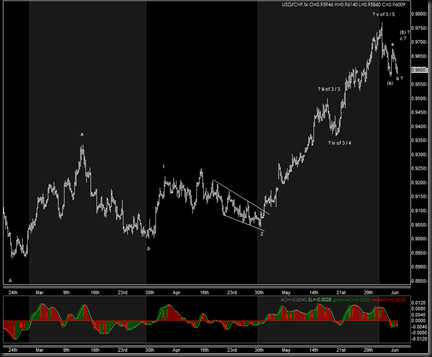

4H Chart

On the 4h chart, my preferred count is that we have completed wave v of 3, and are in the process of a wave 4 decline. The decline while strong looks very much like a 3-wave structure. And since it is a wave 4 decline, I’m expecting a deeper retracement to correct the entire wave 3 structure.

15min Chart

Down to the 15min chart now. Even at the 15min chart, the decline looks corrective. And it looks like we have a 5 wave up for a wave a of (b). My view of the short term is a rally to around the 0.9685 region where we can look for shorting opportunities.

If you are feeling adventurous, you can look at taking a long position when price makes a higher high, with a stop below the low of wave (a) around 0.9570. Remember though, that in the daily timeframe, there’s a long pin bar which may indicate a larger decline in the longer time frame.

Immediate-Term Bias : Bullish

Medium-Term Bias : Bearish

Safe Trading!