It’s the weekend again. Time to take a step back and look at the charts from ground up. I’ve learnt that during the week, I can end up looking at the smaller timeframe and lose track of the larger time frame, and the weekend is a good time to recalibrate.

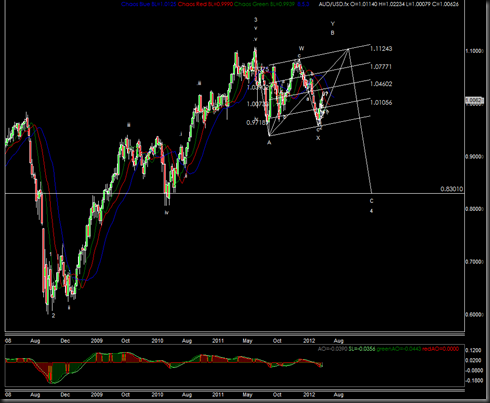

Weekly Chart

Prices have been moving up strongly and nicely as predicted in the longer timeframe. Nothing yet in this timeframe to make me change my mind. That’s expected though, since it’s a long timeframe…. so if it’s wrong, it will take a longer time too. A reason why I look at the lower timeframe too.

1h Chart

Here’s the 1h chart. Please ignore the near horizontal lines cutting across the charts. The lines drawn on the weekly timeframe becomes abit haywire in the lower timeframe.

It looks like a decline has started. There’s a trendline break, and the move down looks fairly impulsive. Meaning we might be having a zig-zag for a correction. My alternate count is that my wave 3, is in fact wave 5, and we are looking at a larger decline. Either way, my short term view is for this to go lower.

1h Chart

I’ll be looking to go short at the 50%-61.8% retracement levels – see the shorting area on my chart. Those levels also happen to coincide with some natural support and resistance levels. Once the corrective move up unfolds in a more countable A-B-C pattern, then we can have a more precise entry level target.

Stop loss will be about 100-125 pips away behind the peak of the high. I’ll keep my size small. Once price confirms, I’ll lower the stop loss and increase my position size to manage my risk.

Good luck with your trading!