EWI's senior analyst Jeffrey Kennedy shares with you practical advice on what it takes to improve the quality of your trades.

By Elliott Wave International

You've heard it all before:

- If you want to trade using Elliott wave analysis, to succeed you first need to understand its rules and guidelines.

- You need a clearly defined trading strategy (what? when? how? etc.) and the discipline to follow it.

- Additionally, your long-term success depends on adequate capitalization, money management skills and emotional self-control.

Do you meet these qualifications, yet still struggle in the markets? If so, you may find some helpful advice in this quick trading lesson from Elliott Wave Junctures editor Jeffrey Kennedy:

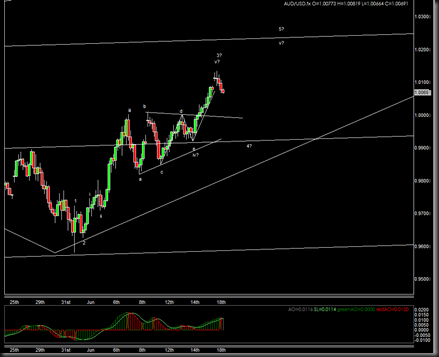

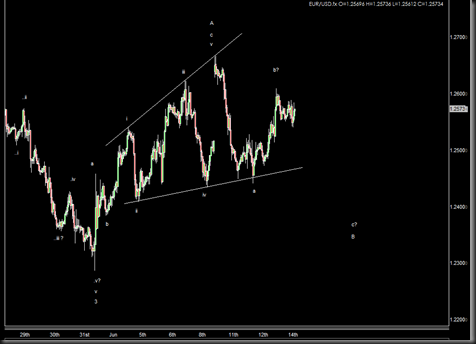

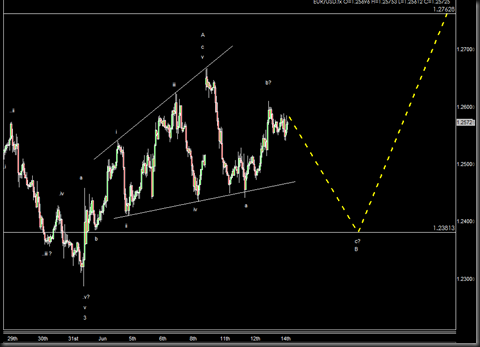

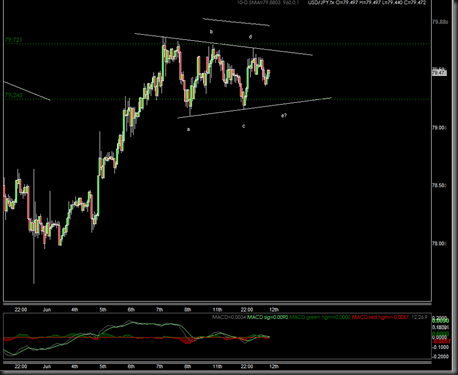

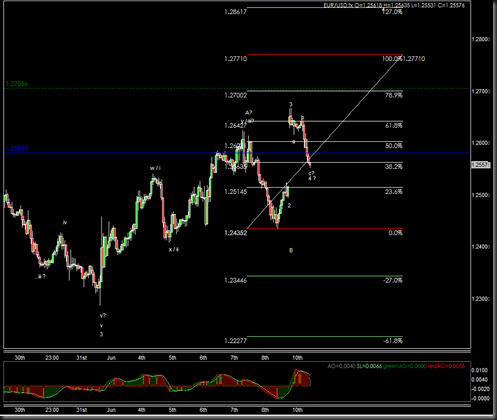

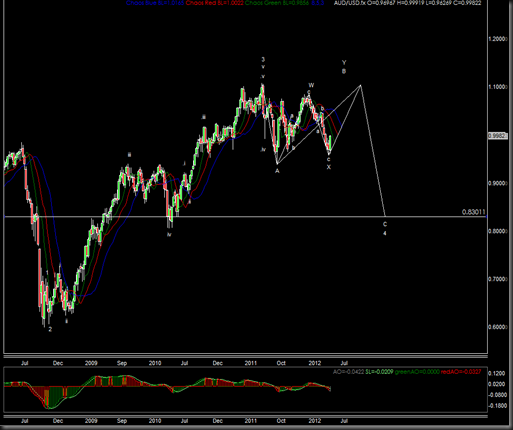

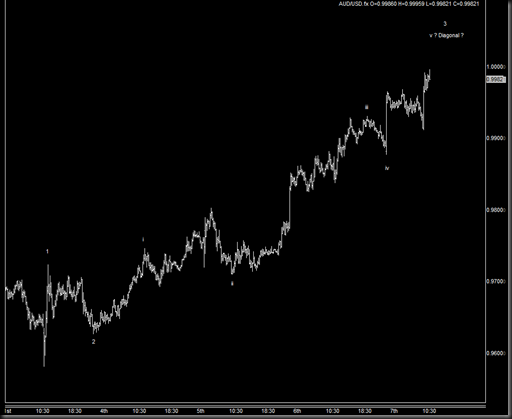

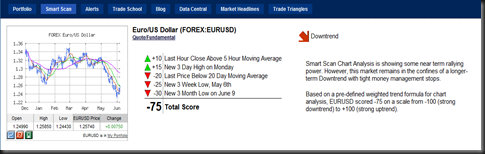

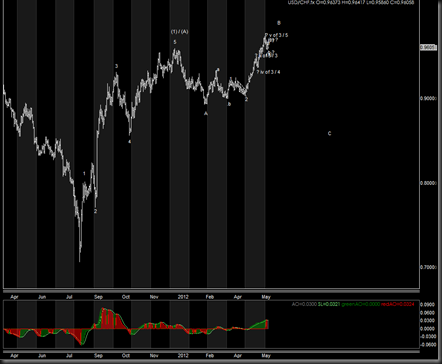

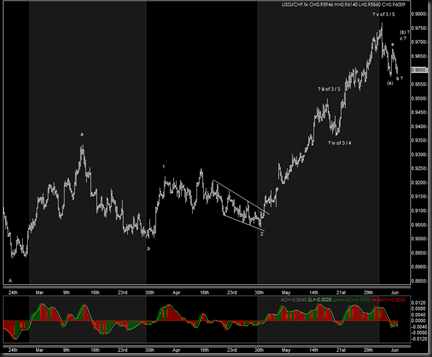

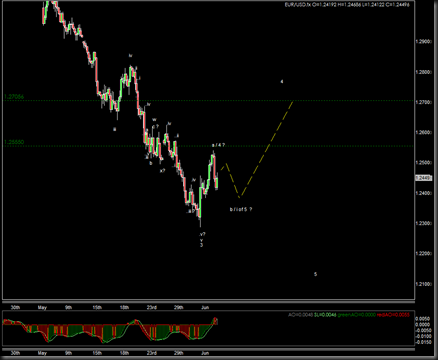

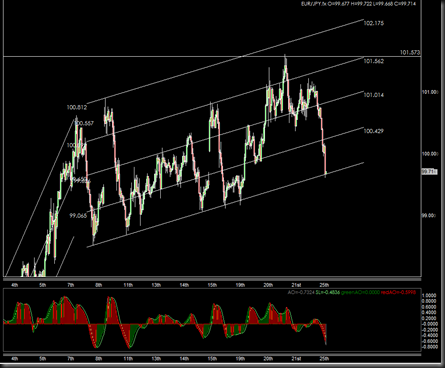

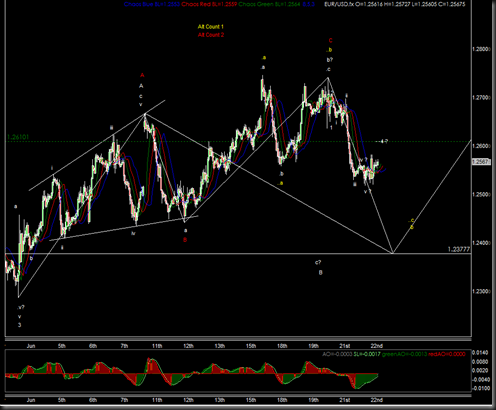

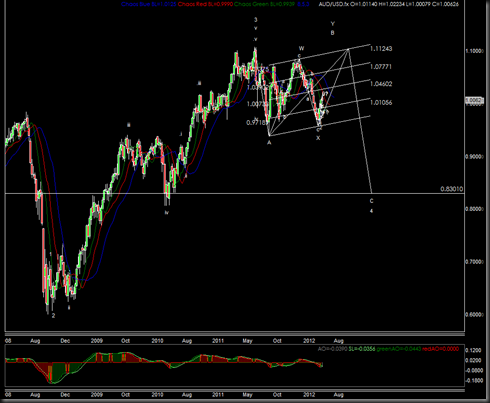

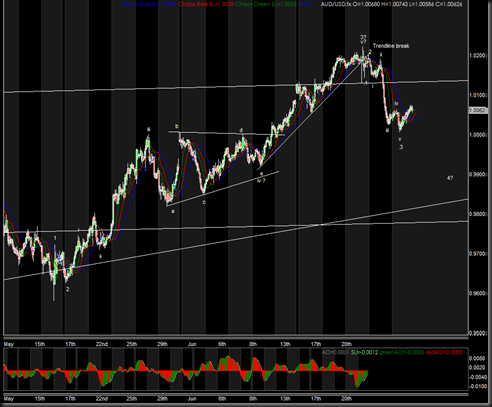

We all know that the Elliott Wave Principle categorizes 3-wave moves as corrections and, as such, countertrend moves. We also know that corrective moves demonstrate a stronger tendency to stay within parallel lines, and that within A-B-C corrections the most common relationship between waves C and A is equality. Furthermore, we know that the .618 retracement of wave 1 is the most common retracement for 2nd waves, and that the .382 retracement of wave 3 is the most common retracement for 4th waves.

Knowing that all of these are traits of countertrend moves, why do traders take positions when a pattern demonstrates only one or two of these traits? We do it because we lack patience. We lack the patience to wait for opportunities that meet all of our criteria, be it from an Elliott wave or another technical perspective.

What is the source of this impatience? It could be from not having a clearly defined trading methodology, or not being able to control emotions. However, I think impatience stems more from a sense of not wanting to miss anything. And because we're afraid of missing the next big move, or perhaps because we want to pick up some lost ground, we act on less-than-ideal trade setups.

Another reason traders lack patience is boredom. That's because -- and this may sound odd at first -- "textbook" Elliott wave patterns and ideal, high-probability trade setups don't occur all that often. In fact, I have always gone by the rule of thumb that for any given market there are only 2-3 tradable moves in your chosen time frame. For example, during a normal trading day, there are typically only two or three trades that warrant attention from day traders. In a given week, short-term traders will usually find only two or three good opportunities worth participating in, while long-term traders will most likely find only two or three viable trade setups in a given month, or even a year.

So as traders wait for these "textbook" Elliott wave patterns and ideal, high-probability trade setups to occur, boredom sets in. Too often, we get itchy fingers and want to trade any chart pattern that comes along that looks even remotely like a high-probability trade setup.

The big question then is, "How do you overcome the tendency to be impatient?" Understand the triggers that cause it: fear of missing out, and boredom.

The first step in overcoming impatience is to consciously define the minimum requirements of an acceptable trade setup and vow to accept nothing less. Next, feel comfortable in knowing that the markets will be around tomorrow, next week, next year and beyond, so there is plenty of time to wait for the ideal opportunity. Remember, trading is not a race, and over-trading does little to improve your bottom line.

If there is one piece of advice I can offer that will improve your trading skills, it is simply to be patient. Be patient and wait for only those textbook wave patterns and ideal, high-probability trade setups to act. Because when it comes to being a consistently successful trader, it's all about the quality of your trades, not the quantity.

Developing patience isn't easy -- yet, if you are serious about improving the quality of your trades, it is vital.

How much more successful would you be if you could develop the patience to act only on high-probability trade setups?

Jeffrey Kennedy shares his 20 years of wisdom in analysis and trading -- to help you decide when to act -- in a new FREE report, 6 Lessons to Help You Find Trading Opportunities in Any Market.

This report includes 6 different lessons that you can apply to your charts immediately. Learn how to spot and act on trading opportunities in the markets you follow.

Get Your Free Trading Lessons Now >>

This article was syndicated by Elliott Wave International and was originally published under the headline How to Build Consistent Trading Success. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

.jpg)