Happy New Year everyone!! I hadn’t done any forecast for a long time, and that’s because I’d been hard at work at brushing up my trading, analyzing my trades, etc. I’d stopped trading in mid-dec 2011, and am starting to resume.

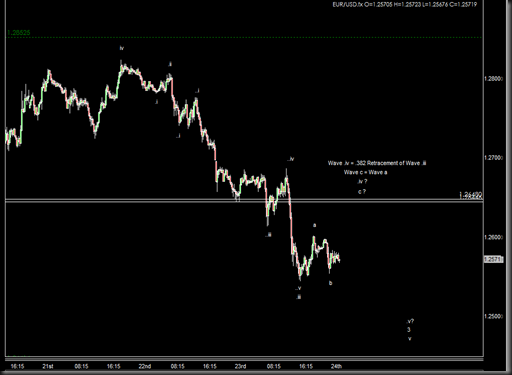

Here’s a quick and dirty forecast based on what I see for EURUSD.

Based on the daily chart:

- Price has retraced 61.8% of its price movement.

- Price is currently at a previous low, a support level (see red line).

- Price is showing divergence (see green line)

I’m counting this as a complex correction. and for my final corrective wave down, I have wave c = wave a.

These series tells me that EURUSD’s momentum seems to be slowing, and I’m actually looking for some upside. I’ll be looking for opportunities to go long from here.

Ok, and on the 4h, the recent wave down looks anything but pretty. I must say it’s hard to count 5 waves for a wave C, and the price appears to be bounded by parallel lines. But we can see some divergence happening right now as well.

The 15 min chart shows some divergence, and then a sharp rejection of prices. I think that trade volume is still rather low right now, and prices look erratic. My sense is that prices will probably head downwards abit more before I have my more sustained upward rally.

Well, that’s my 2 cents worth. Do your own due diligence to your own personal satisfaction before trading. My position of the market may also change based on how the price patterns unfold. Afterall, its more important to be profitable than right in trading!

Good luck!