Elliott Wave International's Jeffrey Kennedy explains many ways to use this basic tool

The following trading lesson has been adapted from Jeffrey Kennedy's eBook, Trading the Line -- 5 Ways You Can Use Trendlines to Improve Your Trading Decisions. You can download the 14-page eBook here.

"How to draw a trendline" is one of the first things people learn when they study technical analysis. Typically, they quickly move on to more advanced topics and too often discard this simplest of all technical tools.

Yet you'd be amazed at the value a simple line can offer when you analyze a market. As Jeffrey Kennedy, editor of the new Elliott Wave Junctures service, puts it:

"A trendline represents the psychology of the market, specifically, the psychology between the bulls and the bears. If the trendline slopes upward, the bulls are in control. If the trendline slopes downward, the bears are in control. Moreover, the actual angle or slope of a trendline can determine whether or not the market is extremely optimistic or extremely pessimistic."

In other words, a trendline can help you identify the market's trend. Consider this example in the price chart of Google.

That one trendline -- drawn between the lows in 2004 and the lows in 2005 -- provided support for a number of retracements over the next two years.

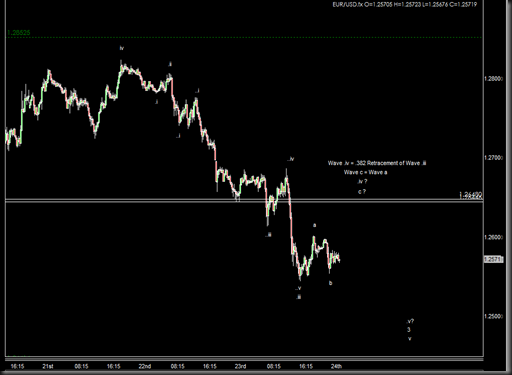

That's pretty basic. But there are many more ways to draw trendlines. When a market is in a correction, you can draw a trendline and then draw a parallel line: in turn, these two parallel lines can create a channel that often "contains" the corrective price action. When price breaks out of this channel, there's a good chance the correction is over and the main trend has resumed. Here's an example in a chart of Soybeans. Notice how the upper trendline provided support for the subsequent move.

For more free trading lessons on trendlines, download Jeffrey Kennedy's free 14-page eBook, Trading the Line -- 5 Ways You Can Use Trendlines to Improve Your Trading Decisions. It explains the power of simple trendlines, how to draw them, and how to determine when the trend has actually changed.

Download your free eBook >>

This article was syndicated by Elliott Wave International and was originally published under the headline How a Simple Line Can Improve Your Trading Success. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.