Recently, I’ve come across this concept of building 7 pips a day to build a million dollars in 3 years. And with the power of compounding, this doesn’t seem all that improbable. After all, Einstein did declare that the power of compound interest is the most powerful force in the universe.

Here’s the theory of what I’ve come across recently (though I’m sure this idea has been around for a long time!):

- You risk 5% of your account as your risk/money management.

- Target Monthly Profit – 25% (7 pips a day x 22 trading days = 154 pips a month)

- Starting Capital $500

For the first month, 1 pip was equals to $1, so 154 pips was $154 i.e. 30% profit which is already more than the target 25%. So by projecting 25% monthly, the author provides the following projection:

So theoretically, we grow an account from $500 to $1.5m in just 3 years!! And with just 7pips a day… that actually seems very achievable!

I don’t actually have more information other than what I just wrote. I don’t know what the trading system is, i.e. Entry and Stop loss. And I will assume that the trade is closed once 7pips are hit – i.e. a daily hunt for 7pips.

Dissecting the Idea

The idea is extremely exciting, and I’ve heard of people who told me it was working well for them (they have their own entries and stop loss strategies). But I’m one for analysing if this is the approach for me.

Psychologically and on first impression, I think that 25% target profit monthly is somewhat of a stretched target for me at this point. And at the same time, I think that 5% risk is a little too high for me because the risk of drawdown from consecutive losses can build up pretty quickly.

At $1 per pip, that’s a mini-lot. So the author is trading a mini-account with a starting capital of $500. At a 5% risk level, his risk is in fact only $25 bucks (500 x 5%), i.e. 25 pips. So with a target of 7 pips, that’s a reward/risk ratio of 7/25. This means that If the risk is 1R, the reward is 0.28R. This means he will need to have 78.1% winning trades just to breakeven!

Next, I tried to calculate what’s the winning percentage that’s required to make 7 pips a day with such a risk-reward ratio. Any guesses? The answer is….. *Drum roll*….. 100%!! Any loss at all will take your average below 7 pips. So over long term, unless your wins of 7 pips are close to 100%, I don’t think this will work.

Achieving 7 pips seems like an achievable task….. how about getting close to 100% wins? Is that achievable? Perhaps there’s some guru out there who can, but I’m lead to believe that’s not a probable target for me.

Tweaking the Idea

Don’t worry, I’m not going to just throw cold water on this idea. I’m going to attempt to tweak the idea a little. Let’s assume that instead of targeting just 7 pips, we now target a 1:1 risk-reward ratio. So now our new target is 25 pips per trade, but we still need only on average 7 pips in a day. Now I can calculate a winning percentage that’s more probable – 64%. If you can achieve a winning percentage of at least 64% on average, you would have averaged at least 7pips a day.

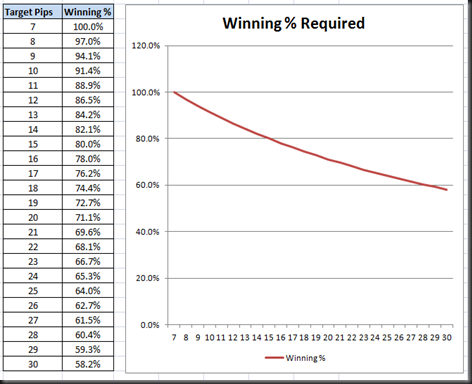

So now, I have tweaked the idea from achieving close to 100% wins of 7 pips daily, to about 64% wins of 25 pips daily. For me, that’s a more probable approach to the idea of building 7pips daily. So the broader objective is the same, but the perspective is different. Of course you can always keep the 7 pips expectancy, tweak the target of 25pips and look at the required winning percentage accordingly. Here’s a table below:

So here you have my take on the 7 pips a day approach to trading. This does not cover the trading system / strategy itself, but rather what is the expected performance of the system to achieve the same objective of the 7-pips a day approach.

What do you think? Well, I hope this provided you with a new or alternative way of thinking about approaches to trading.

That’s all for today, good luck with your trading!